CEO compensation has been a contentious issue for some years now. Plenty of non-CEOs think it’s too high, or too high relative to “normal” people. And plenty of people think that many CEOs are taking advantage of their positions to, how shall we say it, extract more value from the company and stockholders than is their due. And plenty of people think it’s too high and a symptom of a general out-of-control corporate governance situation in the US.

Between the commsymps on one pole and the “So what? It’s a free market and if it takes big money to find the right guy, who are you to argue?” crowd on the other, there may be a middle ground.

But I don’t care, for the moment.

Instead, it seemed like fun to find out what the correlation is between CEO pay and, oh, let’s just take a random measure of CEO performance: stock appreciation.

Now, there are probably very accurate ways to do this sort of thing, but I chose the quick way:

Snag the CEO pay numbers from the AFL-CIO web site.

Match ’em up with the stock performance for the last 3 years (as told by Yahoo Finance).

Viola!

OK. There are a lot of things wrong with this. For example:

- Can you believe that the AFL-CIO site may have an axe to grind? Well, duh. But, I figure that they’ll grind their axe for all of the companies they list in pretty much the same way.

- What if the CEO has just come on board? That makes the stock history irrelevant. Maybe. But, I figure there won’t be that many new CEOs to fudge the numbers.

- CEO pay is notoriously jagged. Think entertainer income. One year it’s big, the next, it’s zero. Straight-faced people call this “risky”. But then, staight-faced people confuse stock market “beta” with risk, too. Anyway, yeah, using 1 year of CEO numbers is going to include a lot of noise. But, I figure the noise won’t cancel the signal for over 1300 CEOs.

- What about dividends? I’m assuming that they, too, don’t have a lot of effect on correlation. With 1300 companies, you gotta figure that dividends will just shift some of the dots in the scatter plots below slightly to the right.

OK, where does all this lead to?

Well, the correlation between CEO pay and stock appreciation for the last 3 years is … the envelope please:

0.0281944460185

Hmmm.

This is about as uncorrelated as you can get. Zero, if you drop the 100ths. And that’s for 1323 CEOs “raking in” anywhere from 1 buck (Steve Job’s phony number) and 131 mill (Ouch. I owned some HD stock.)

Did outliers trash the correlation?

Let’s look at the pictures:

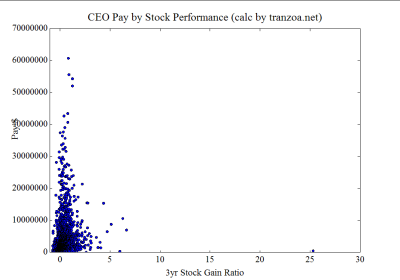

First, here is the scatter plot:

The outliers do make it hard to see the crowd.

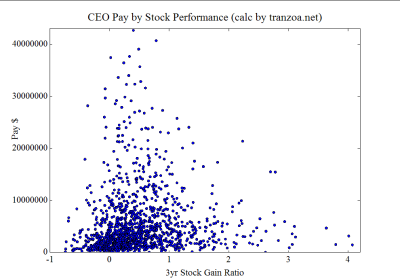

Let’s zoom in a bit:

I don’t see the ramp of dots leading from southwest to northeast that would be seen if the big pay and big return guys were the same guys. From this image, though, you can see that the market has gone up in the last 3 years. The center of the dots eyeball to be about 0.4 in X. That’s another way of saying that stocks have gone up 40%. (The actual calculation here is (current_price – old_price) / current_price.)

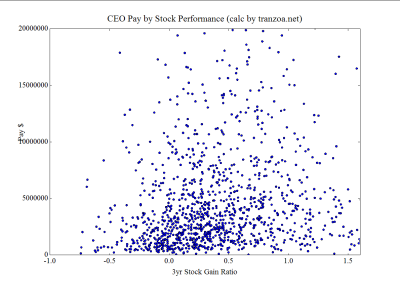

Finally, let’s clip out all but the bulk of ’em.

What can be said? The 0.03 correlation sums it up very well.

So, does that mean the a company can can their CEO and hire a Magic 8 Ball? Well, sure. They can. But do they want to?

It’s too bad that these numbers don’t answer the question.

Remember that there are no comparisons in these numbers to companies that have a Magic 8 Ball for CEO.

But, certainly these numbers make one wonder about the possibility of automating the CEO’s job. Heck, it’s hard to automate jobs that can be easily measured. Think of how easy it would be to automate a job with no solid feedback.

Finally, let’s open up another curtain.

Remember that if stock prices followed CEO pay, the prices would adjust to make the CEO’s pay uncorrelated to stock performance. Assuming that’s true changes little, tough, because this total lack of correlation between pay and what the stock has already done does lead to one simple question:

What are CEOs paid for?

It’s sure not for stock performance.