A few months back, the gold Honda’s cassette deck died.

I listen to audio books from KCLS in the car. Romances, westerns, and others requiring no thinking of any sort.

So, the dead cassette deck was a very serious thing.

What to do?

Well, logic says that throwing less than a hundred bucks at Fry’s would solve the problem.

But …

Such an opportunity!

Inspiration, and, if I may humbly say so, a stroke of genius, made two things clear:

- Old things were lying around the house, doing nothing. (not meaning the Honda’s owner, mind you.)

- The gold Honda was, how shall we say it, not worth the C note. Let’s examine the evidence:

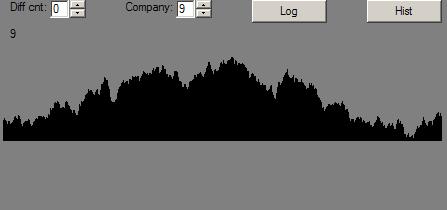

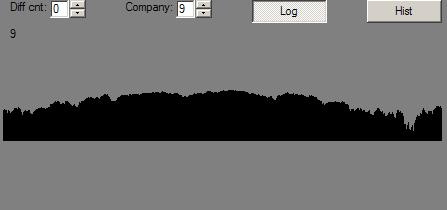

So, here are pictures of the simple, no-cost replacement for that broken cassette deck:

First, the equipment must be plugged in to the lighter socket:

And, for the parts we have:

Let’s review this simple arrangement:

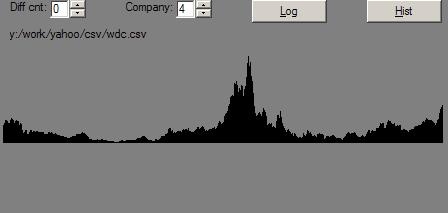

- Power – a good inverter comes in handy. Producing plenty of 120v power from the cigarette lighter socket with, uh, some little fan noise. … OK, a lot of fan noise. But, hey, it’s in a car, so who can hear it? Anyway, it feeds to the…

- Power strip – you never know what you might want to plug in to the car, after all. (I tried a refrigerator once. It didn’t work.) And since we’re talking about sophisticated electronics here, you cannot have too many over-current breakers in the circuit. Plugged in to the power strip is a …

- DC converter – We need DC power, so an old Radio Shack universal AC-DC converter does the trick. It powers …

- The cassette deck itself – We can’t forget this item, can we? Luckily, stashed away in a forgotten box were a couple of these old things – probably older than the car, this one is. It plays the audio to …

- Headphones – Finally, there must be a way to hear the audio.

But wait!

There’s more!

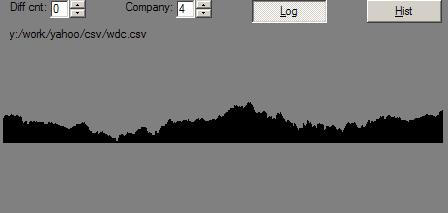

This picture was taken after Scott borrowed the FM transmitter. Too bad. That noisy, battery-eating device was truly the perfect way to complete the circuit back to the car’s radio.

And, too bad this picture does not show the battery-powered, noise cancelling headphones that should be used in such an advanced audio system as this one. They are in the glove compartment.

So, kids, if your car’s sound system fries, just come to us here at Kludge Central. We can get you going for double anything you’ll pay on the street.